NON-LIFE INSURANCE

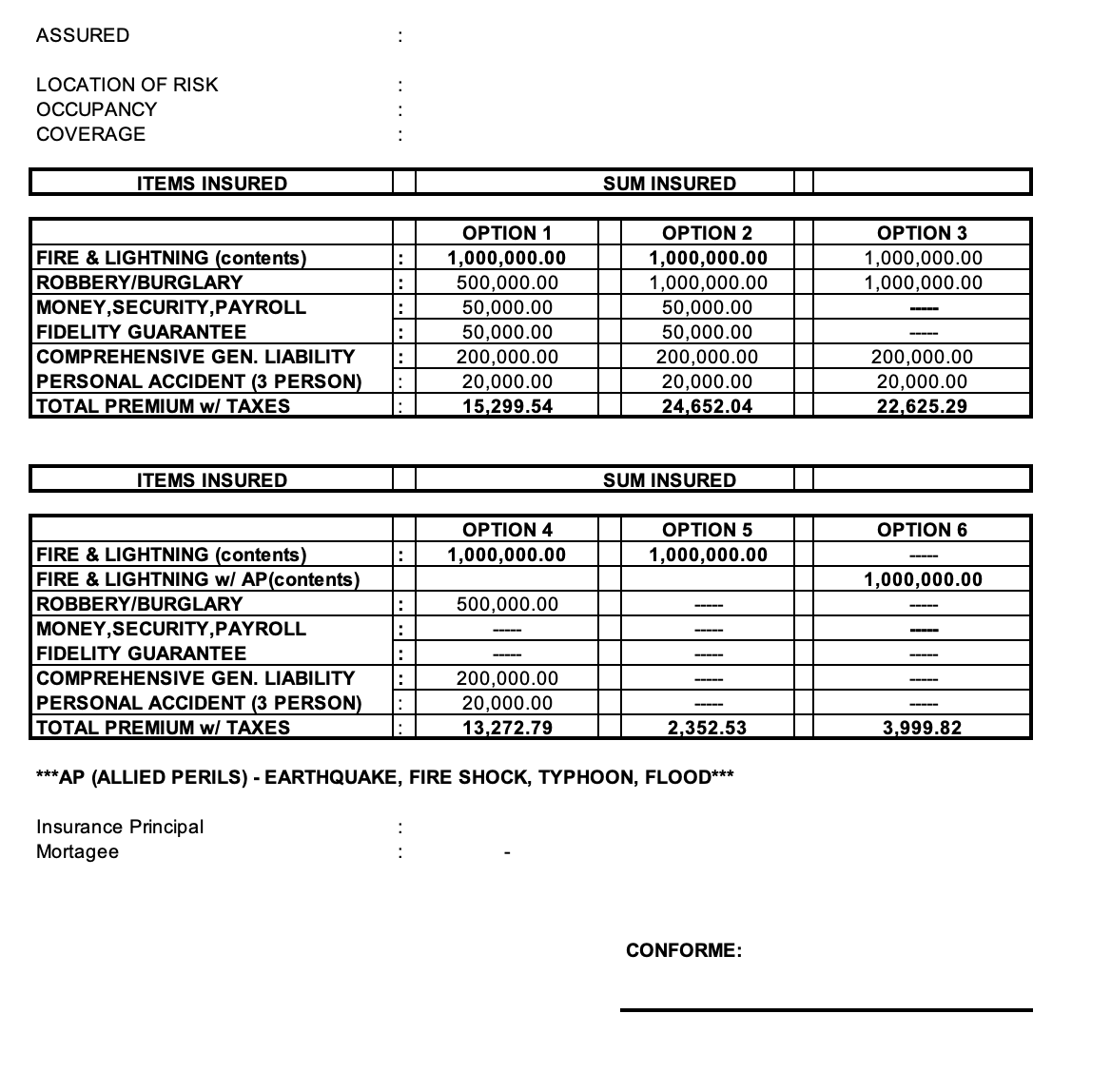

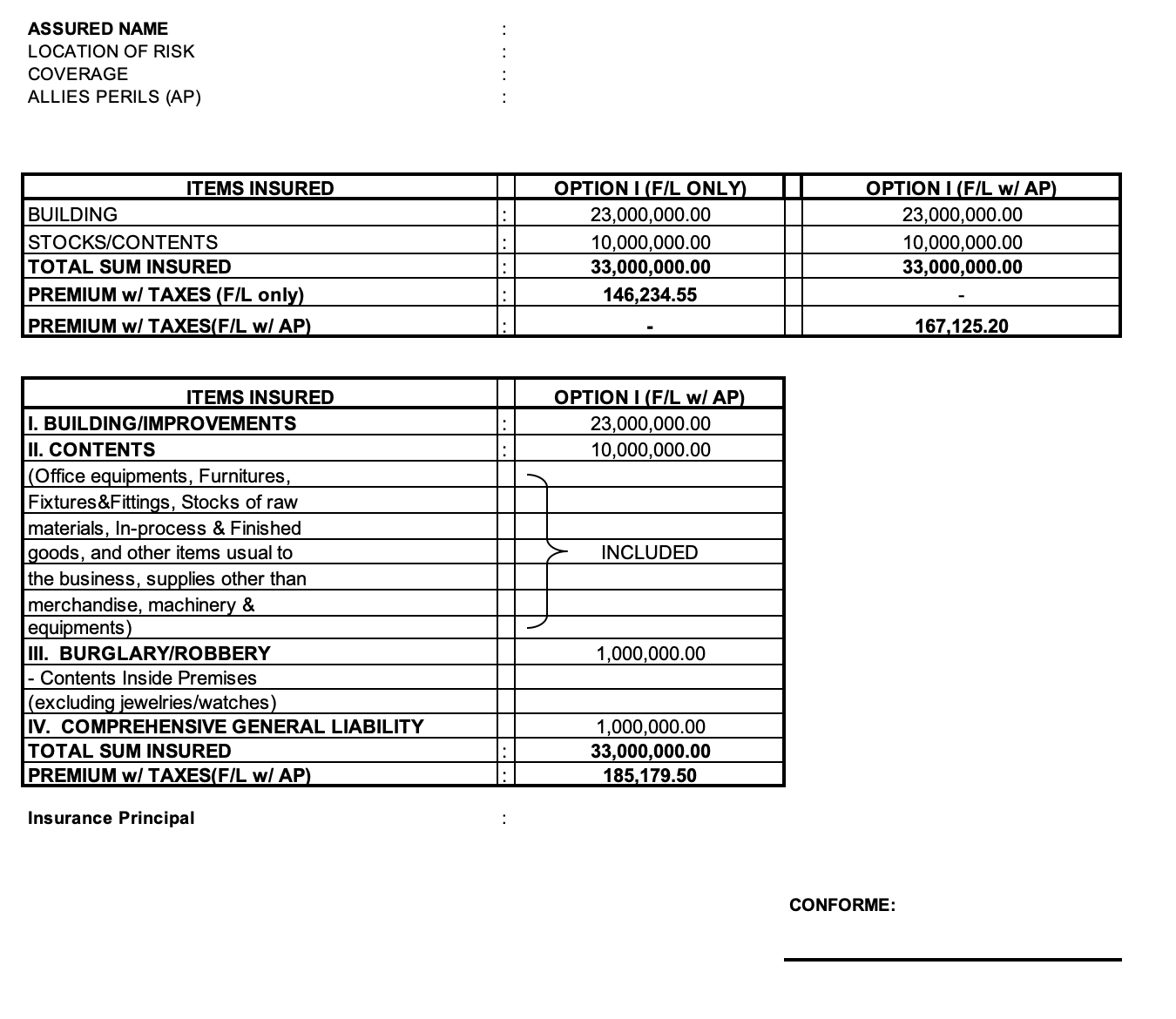

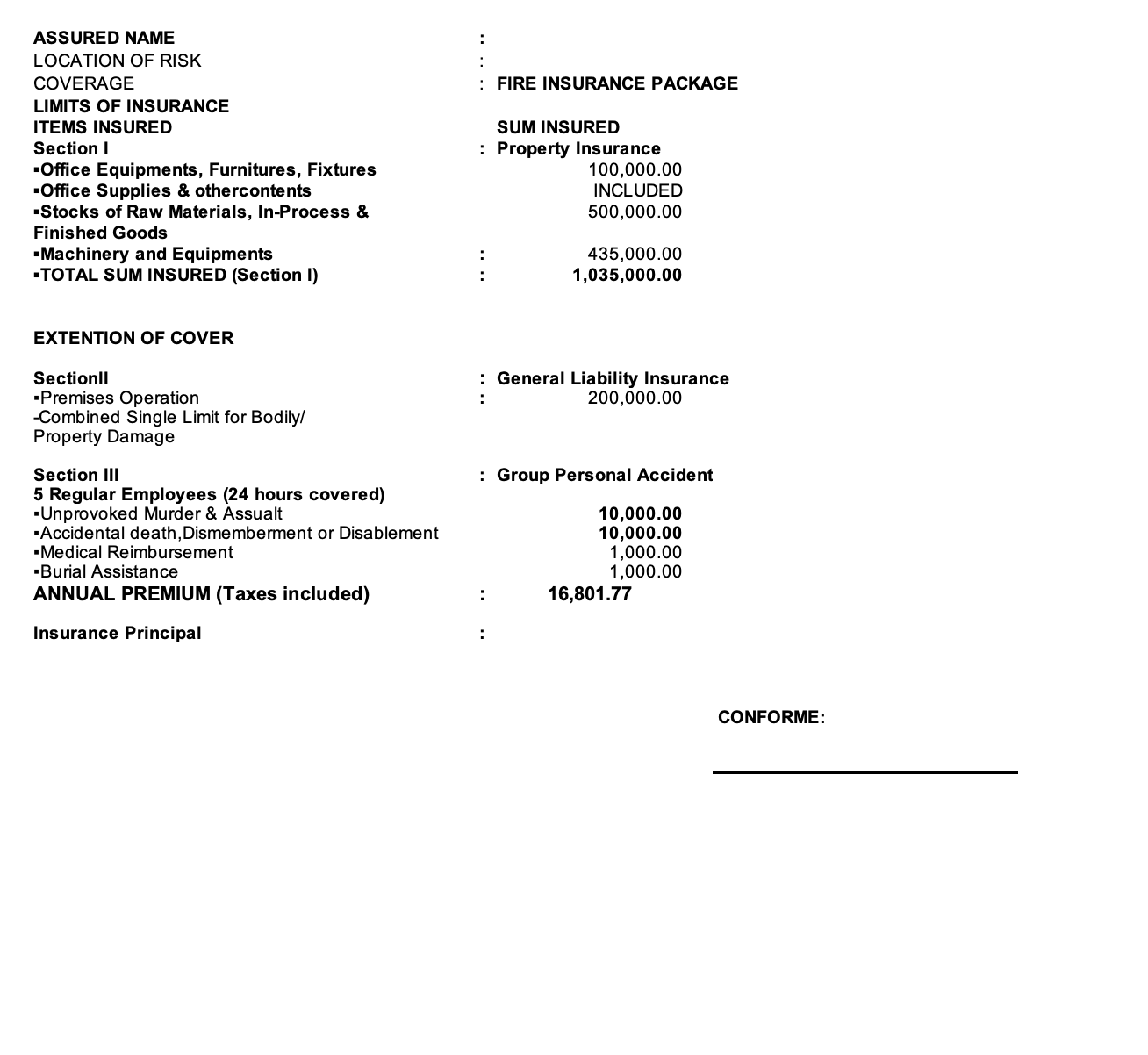

Insurance against physical loss or damage caused by fire and lightning to the insured’s property such as buildings, machinery and equipment, stocks in trade, goods in process, household furniture, fixtures, appliances, personal effects (excluding cash and jewelry) and other fixed properties.

Insurance against risks connected with navigation to which the ship, cargo, freightage, profits, or other insurable interest in movable property may be exposed during a certain voyage or a fixed period of time.

Provides comprehensive protection against loss or damage to contract works, erection works, construction plant and equipment and/or construction machinery; breakdown of electronic equipment and machinery; as well as third-party claims (property damage or bodily injury) arising in connection with the execution of a construction or erection work or explosion of boilers and pressure vessels.

- Property Floater – Insurance coverage for expenses incurred from loss or damage to movable property, such as heavy equipment, machinery, portable electronic equipment, paintings, and jewelry.

-

Merchandize Floater – Insurance coverage for expenses incurred from loss or damage to various cargo in-transit, against truck risks, from perils of the road, robbery, or hijacking.

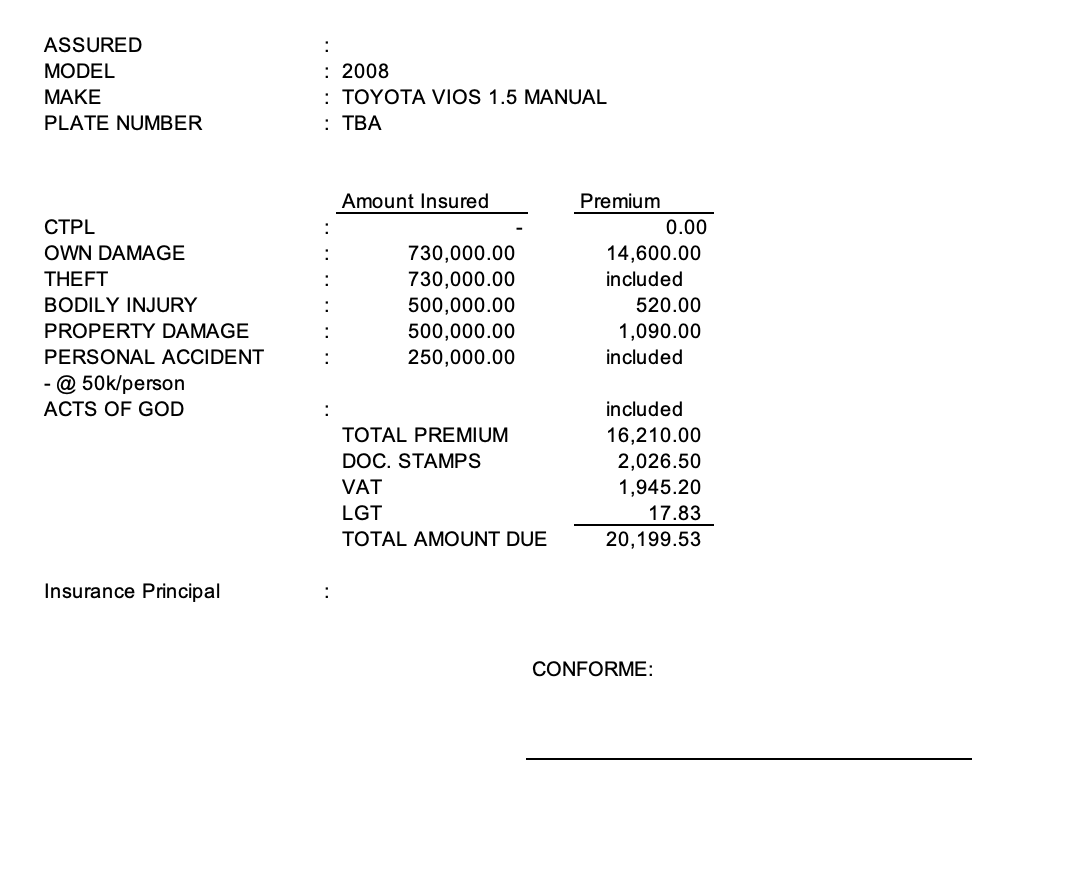

Insurance against loss, damage, and/or liability incurred by the insured resulting from accidents arising from the ownership and operation of his motor vehicle.

Insurance coverage geared specifically to the operation of aircraft and the risks involved in aviation. Aviation insurance policies are distinctly different from those for other areas of transportation and tend to incorporate aviation terminology, limits and clauses specific to aviation insurance.

A contract whereby the insurer, for a consideration, agrees to indemnify the insured in the event that the insured is held financially and legally liable for damage to another party’s property or injury to another person arising from an accident due to the insured’s negligence, in connection with the insured’s business, as described in the schedule, occurring within the geographical limits.

Provides coverage against direct financial losses caused by criminal activities.

INDICATIVE RATES

NOTE: Please click below to see indicative rates for fire, motor and personal accident insurance plans. The final premium rate will be calculated based on condition of assets, claims history and other underwriting guidelines of the insurance company.

FIND THE BEST TALENT AND KEEP THEM!

Let Responsive help you develop the best comprehensive benefits plan to help entice and retain the best talent for your business. When your team feels secure, they’re able to focus and contribute to the company’s greater goals.

We can take care of your people,

so that they can take care of your business.